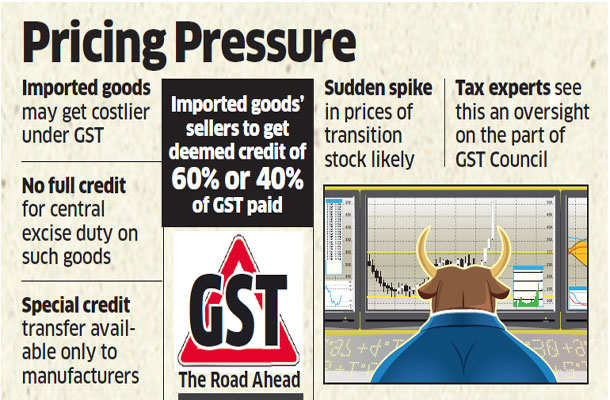

Consumer durables such as smart phones that are imported could see a temporary spike in prices as India transitions to the goods and services tax (GST) that’s set to be rolled out from July 1. That’s because the benefit of the special credit transfer scheme has been restricted to manufacturers.

The latest transition rules approved by the GST Council allow full credit for central excise duty paid on goods over Rs 25,000 that have a chassis number or any other identification for tracking the product. But this facility is available only for manufactured goods.

Thus, those selling imported goods will need to claim deemed credit of 60% or 40% of the central GST paid, depending on the tax rate levied on the products.

They will not be able to claim credit of the entire amount of countervailing duty and additional customs duty paid on such imported goods, possibly leading to a sudden spike in prices of transition stock.

This issue will especially impact the electronics and consumer goods industry, where in a number of cases, goods are imported as completely built units and resold in India without carrying out any further processes.

Tax experts said this appears to be an oversight.

“If the intention is to neutralise the impact of existing central taxes paid on transition stock of high-value items, then logically even imported goods should be covered,” said Pratik Jain, leader, indirect taxes, PwC. “The disparity would mean that consumer electronics, durables and cell phones which are imported would suffer more tax than ones manufactured domestically. The government should surely review this.”

Experts are also seeking clarity on how to determine the value of Rs 25,000 per piece — whether it should be maximum retail price, purchase price or any other value.

The council has set up 18 groups to interact with sectors such as telecom, banking and exports and resolve issues in a time-bound manner for a smooth transition to the new indirect tax regime.

These sectoral working groups consist of senior officers from the Centre and states who examine representations received from trade and industry groups. These groups will highlight specific issues for the smooth transition of the respective sector to the GST regime and prepare sector-specific draft guidance.

The latest transition rules approved by the GST Council allow full credit for central excise duty paid on goods over Rs 25,000 that have a chassis number or any other identification for tracking the product. But this facility is available only for manufactured goods.

Thus, those selling imported goods will need to claim deemed credit of 60% or 40% of the central GST paid, depending on the tax rate levied on the products.

They will not be able to claim credit of the entire amount of countervailing duty and additional customs duty paid on such imported goods, possibly leading to a sudden spike in prices of transition stock.

This issue will especially impact the electronics and consumer goods industry, where in a number of cases, goods are imported as completely built units and resold in India without carrying out any further processes.

Tax experts said this appears to be an oversight.

“If the intention is to neutralise the impact of existing central taxes paid on transition stock of high-value items, then logically even imported goods should be covered,” said Pratik Jain, leader, indirect taxes, PwC. “The disparity would mean that consumer electronics, durables and cell phones which are imported would suffer more tax than ones manufactured domestically. The government should surely review this.”

Experts are also seeking clarity on how to determine the value of Rs 25,000 per piece — whether it should be maximum retail price, purchase price or any other value.

The transition rules were approved by the GST Council at a meeting on June 3.

The council has set up 18 groups to interact with sectors such as telecom, banking and exports and resolve issues in a time-bound manner for a smooth transition to the new indirect tax regime.

These sectoral working groups consist of senior officers from the Centre and states who examine representations received from trade and industry groups. These groups will highlight specific issues for the smooth transition of the respective sector to the GST regime and prepare sector-specific draft guidance.

0 comments:

Post a Comment